Our Services

Matsock & Associates provides a wide range of services for all your Employee Benefit, Insurance, and Financial needs. We offer group benefits that are both fully Insured , Partially and Self-Funded.

Employee Benefits

- Medical (Fully-Insured & Self-Insured)

- Dental

- Vision

- Life Accidental Death and Dismemberment (AD&D)

- Short-Term Disability

- Long-Term Disability

- COBRA & MINI COBRA

Voluntary Benefits

- Accident

- Hospital Indemnity

- Critical Illness

- Cancer

- Whole Life

- Term Life

- Accidental Death and Dismemberment (AD&D)

- Long-Term Care

- Short-Term Disability

- Long-Term Disability

Retirement Benefits

- 401 (K) Administration

- Pension/Profit-Sharing

- Annuities

Other Services

- Contract Analysis & Negotiation

- Plan Design Analysis

- Online Enrollments

- On-Site or Near-Site Clinics

- Wellness Programs

- Pharmacy Benefit Management

- Customized Communications

- TPA Analysis

- Medical Bill Review

- Reference Based Reimbursement

- Analytics

- ACA Reporting

- Carrier Analysis

- Pharmacy Benefit Management

- Plan Document

- HR Support

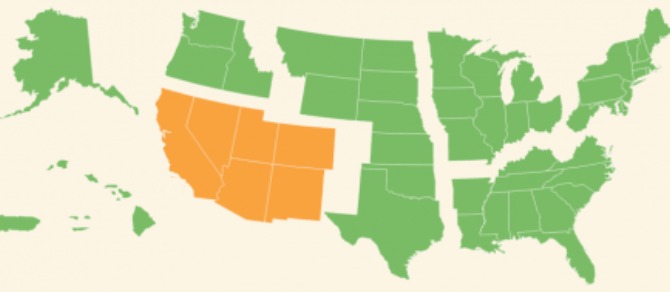

Multi-State Employee Benefit Specialists

Matsock & Associates serves clients throughout the U.S. with the majority of our clients in the Southwest.

We make sure to consult our current clients and prospects by listening and giving them the proper guidance when electing group benefits. Whether you're fully-insured or partially self-funded, we have solutions for you.

"We Like to Work with Good People"

Let Us Help You

Self-Funded

Instead of paying an insurance company to pay the claims (and keep any profits) a self-funded employer or plan puts money into a trust fund that is regulated by the federal government, and that trust fund pays the claims and keeps any profits on behalf of the plan.

Stop-Loss

In order to protect the employer from the financial burden under a partially self-funded plan, it is recommended that reinsurance or stop loss coverage is purchased in order to limit and cap the liability that the employer has under this agreement.

Third Party Administer (TPA) Selection

Third Party Administration selection is very important part of the self- funding process. If you don't have a TPA that will play the same game, it's hard to change anything.

Network Selection

Selecting the right network for your group benefits is one of the single most important decisions. Let us guide you through the pros and cons of using the BUCAH's.

Self-Funded vs. Level Funding

Partially self-funded plans offer an alternative to traditional health insurance plans. It allows companies to budget for small predictable claims while protecting the group against unpredictable catastrophic claims, through the purchase of stop-loss protection.

Our Solutions

Matsock & Associates can help you accomplish your goals. We have the knowledge to design benefit plans that meet your objectives. Using our expertise with over 35 years of experience, we can help you commit your benefit plans to a proven management process.

Medical Bill Review

Reference Based Reimbursement

Telemedicine

Wellness

Analytics

Compliance

Customized Communications

TPA Analysis

Carrier Analysis

Pharmacy Benefit Management

CONTACT US

We are here to help. Please send us any questions or comments and we will contact you shortly. We look forward to working with you.

info@matsock.com

602.955.0200